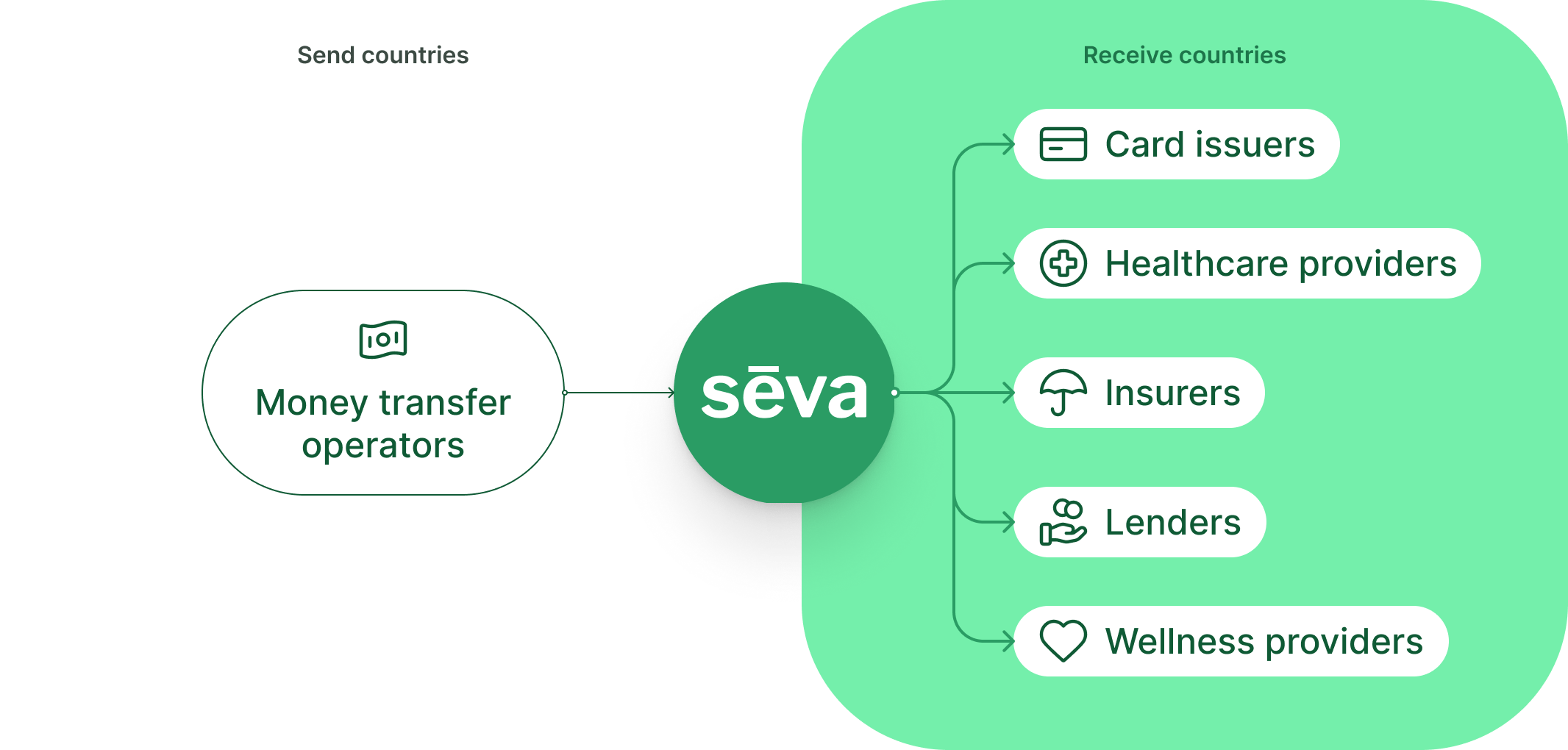

Seva’s platform is more than just a digital integration solution for MTOs; it bridges the gap for Money Transfer Operators (MTOs), providing increased revenue opportunities and customer retention through unique value-added services.

Single integration for MTOs to unlock proprietary, payout card programs and receiver services globally

Unified API platform for varied Partners to integrate into & provide services directly to receivers

Compliance and Security

Seva Tech ensures full regulatory compliance and security, making remittance operations safer and more reliable.

- End-to-End Encryption: Secure data transmission and storage.

- Regulatory Compliance Framework: Stay aligned with global financial regulations.

- GDPR & PCI DSS Compliance: Protect customer data with industry-standard measures.

Developer Resources and Support

Seva provides extensive support and resources to ensure smooth integration and continued success for MTOs.

- Comprehensive API Documentation: Easy-to-follow guides for seamless implementation of API Integration for Money Transfer Services.

- Dedicated Technical Support: Expert assistance available round the clock.

- SDKs & Technical Guides: Platform-specific resources for a hassle-free setup.

- Sandbox Environment & Live Demo: Instantly test integrations with a hands-on preview.

- Continuous Updates & Security Patches: Stay ahead with the latest technology enhancements.

- Custom Development Assistance: Get tailored solutions for unique business needs.

How Seva Integrates

Seva offers digital platforms for remittance providers that guarantee smooth integration, fast setup, and secure, efficient operations for money transfer operators (MTOs).

API & SDK Setup

Embed Seva Services

Launch & Monitor

Got Questions?

We’ve Got Answers.

How long does it take to integrate Seva’s platform?

Seva’s API and SDK are designed for quick and seamless integration. Most MTOs can complete the setup within a few days, depending on their existing infrastructure. Our technical support team is available 24/7 to assist with any implementation challenges.

Can Seva’s platform handle high transaction volumes?

Yes. Seva’s scalable infrastructure is designed to support high transaction volumes without compromising speed or security. Our cloud-based architecture ensures seamless performance, even during peak transaction periods.

What kind of support is available for developers?

We provide comprehensive API documentation, SDKs, and a sandbox environment for testing. Additionally, our dedicated technical support team is available round the clock to assist with troubleshooting, custom integrations, and any other queries.

Ready to Transform Your Business?

Don’t settle for the status quo. Contact us today for a demo and discover how Seva can help you thrive in the future of remittances.

Stay connected with Seva

Get the latest updates, special offers, and insights on how Seva is transforming financial support and healthcare for families back home.

Partnering with leading MTOs, Seva delivers the world’s first remittance-powered card that can be topped up instantly by senders while offering a suite of health and financial services for receivers.